The last Mega Millions jackpot was won on January 17 in Arizona, with a ticket ordered on Jackpocket!

With past Mega Millions jackpots ranging from $20 million up to $1.58 BILLION, you may be wondering which states win Mega Millions the most. Is geography in your favor? Here are America's "luckiest" states for hitting the Mega Millions jackpot.

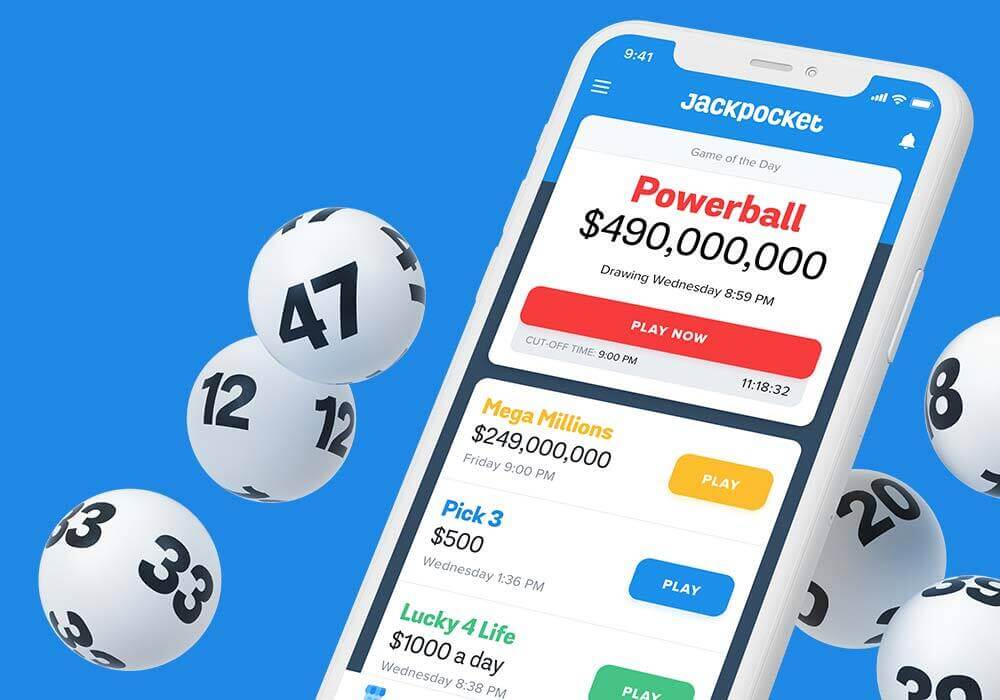

⚡️ Feeling inspired? Get in the game on the Jackpocket lottery app for mobile or desktop.

How Many States Are in Mega Millions?

How many states partipate in the Mega Millions lottery? Mega Millions is available in 47 jurisdictions—45 states plus Washington, D.C. and the U.S. Virgin Islands. The odds of winning the grand prize are 1:302,575,350.

Of all the Mega Millions states, 28 have won Mega Millions jackpots—some more than others! Where does your state rank?

As always, take this list with a grain of salt. South Carolina, for example, has only won one Mega Millions jackpot—but it was a pretty historic one. (#MegaBillions forever).

Plus, there are five states that don’t have state lotteries: Alabama, Alaska, Hawaii, Nevada and Utah. Mississippi's state lottery is still relatively new—it began selling Mega Millions tickets in January 2020. As a result, it doesn't top the list of the most Mega Millions winners by state.

Learn more: How to play Mega Millions

Mega Millions Jackpot Winners By State

Our list shows you which state has the most Mega Millions winners in order of most to least jackpot winners for the state. Is your state in the top 10 winning states?

| State | Jackpots Won | Year of Last Win |

|---|---|---|

| New York | 43 | 2023 |

| California | 35 | 2024 |

| New Jersey | 24 | 2024 |

| Ohio | 20 | 2019 |

| Michigan | 18 | 2021 |

| Georgia | 16 | 2016 |

| Illinois | 15 | 2024 |

| Texas | 15 | 2024 |

| Maryland | 11 | 2014 |

| Virginia | 9 | 2016 |

| Washington | 5 | 2016 |

| Massachusetts | 5 | 2023 |

| Florida | 5 | 2023 |

| Pennsylvania | 3 | 2021 |

| Arizona | 3 | 2025 |

| Indiana | 2 | 2016 |

| Missouri | 2 |

2019 |

| North Carolina | 2 | 2011 |

| Tennessee | 2 | 2022 |

| Arkansas | 1 | 2017 |

| Idaho | 1 | 2011 |

| Kansas | 1 | 2012 |

| Maine | 1 | 2023 |

| Minnesota | 1 | 2022 |

| New Hampshire | 1 | 2019 |

| Rhode Island | 1 | 2018 |

| South Carolina | 1 | 2018 |

| Wisconsin | 1 | 2020 |

| Colorado | 0 |

N/A |

| Connecticut | 0 |

N/A |

| Delaware | 0 |

N/A |

| District of Columbia | 0 |

N/A |

| Iowa | 0 |

N/A |

| Kentucky | 0 |

N/A |

| Louisiana | 0 |

N/A |

| Mississippi | 0 |

N/A |

| Montana | 0 |

N/A |

| Nebraska | 0 |

N/A |

| New Mexico | 0 |

N/A |

| North Dakota | 0 |

N/A |

| Oklahoma | 0 |

N/A |

| Oregon | 0 |

N/A |

| South Dakota | 0 |

N/A |

| Vermont | 0 |

N/A |

| Virgin Islands | 0 |

N/A |

| West Virginia | 0 |

N/A |

| Wyoming | 0 |

N/A |

*Updated as of Mega Millions jackpot win in Arizona on January 17 2024

"Unluckiest" Mega Millions States?

Have the states with no winners truly been unlucky? Probably not. For example, Mississippi only started selling Mega Millions tickets in 2020, whereas other states with the most wins have been participating much longer. New York, the state with the most wins, has been participating in the Mega Millions lottery since 2002. The good news is that no matter which state or town you live in, your ticket has an equal chance of winning. The Mega Millions prize odds don’t change, no matter where you play.

State Lottery Tax Withholdings

Over 30 Mega Millions jackpots have been won in California. Those winners may be counting themselves as extra lucky because California doesn’t withhold state taxes on your lottery winnings like many other states. Basically, the winner didn’t have to pay state taxes on top of federal ones.

Curious how your state ranks for state taxes on lottery winnings? These are the best and worst states to win Mega Millions in terms of state tax owed. All stats were sourced from the official state lottery website in each state.

*Take note! We are not tax experts. For the official word on lottery winnings and your federal and state taxes, double check the gambling income rules laid out at IRS.gov, your state taxing authority and contact a CPA or tax attorney.

Best States for Lottery Taxes

- California, Delaware, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming - 0%

- North Dakota - 2.9%

- Pennsylvania - 3.07%

- Indiana - 3.23%

- Colorado, Missouri, Ohio, Virginia - 4%

Worst States for Lottery Taxes

- New York - 10.9%

- Maryland - 8.75%

- Washington, D.C. - 8.50%

- New Jersey, Oregon - 8.0%

- Wisconsin, Minnesota - 7.25%

Get more info: Lottery taxes by state

Things to Do Immediately If You Win the Mega Millions Jackpot

What’s number one? Celebrate! Then, take a deep breath and get in touch with a CPA, financial planner, or tax lawyer or another combination of experts to help you plan. They will help ensure you have a thoughtful strategy for your winnings in place tailored to you and your goals. They can guide you on whether a lump sum or an annuity is the best option for you and your tax situation. They can also help you prepare for tax time, help with estate planning, and more.

Top 10 jackpots: Check out the top 10 Mega Millions jackpots in history.

Get your Mega Millions ticket on the Jackpocket app for a chance to make your state a winner.