Tax Day is right around the corner. Aside from getting all the necessary paperwork together (always a fun time), do you need the information on your lottery winnings and losses to complete your taxes? You sure do. Can you write off losing lottery tickets on your taxes? Actually, it’s possible.

Lucky for you, Jackpocket keeps a digital record of every ticket you play (win or lose) right in the app. And great records can pay off at tax time. By ordering tickets for the lottery online with us, you’ll have a record of your losses and lottery payouts at your fingertips. Our guide to lottery wins, losses and taxes will provide you with everything you need to know.

Take note! We are not tax experts. For the official word on lottery winnings and your federal and state taxes, double check the gambling income rules laid out at IRS.gov, your state taxing authority and contact a CPA or tax attorney.

Keeping track of lottery winnings and losses

Check out the full rules for how to report gambling winnings and losses on the IRS website here. The short version is:

- Lottery winnings are fully taxable. In fact, all gambling winnings are reported as “Other Income” on your tax form. Whether that’s the grand prize with Mega Millions or a small prize with Powerball.

- It’s possible to deduct some of your lottery losses. For folks who itemize their deductions, it’s possible to deduct your gambling losses from the year up to (but not over) the amount you won. If you have no winnings to report, you may not deduct any losses.

- Keeping good records is essential (and could save you money). The IRS requires you to keep an accurate diary or similar record of your losses and winnings. (Note: You should also be able to provide supplemental records, like payment slips and winning statements, to back up the amounts you report on your taxes.)

A lottery diary? You read that right.

The problem is most people do not save their lottery tickets. Or keep meticulous lottery diaries of all their plays!

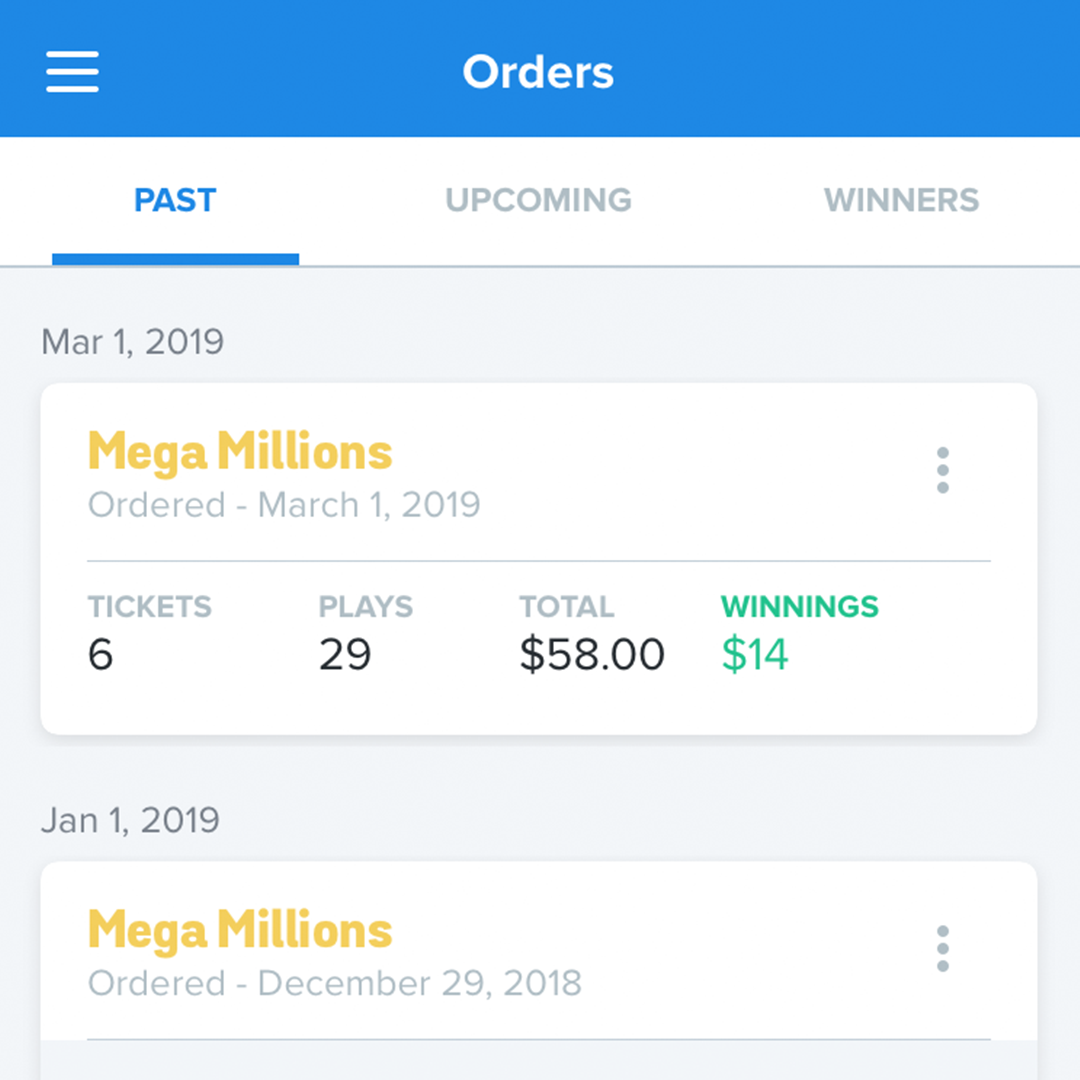

Jackpocket tracks your winnings and losses for you. You can see all your ticket orders anytime in the Orders section of the app. Just tap Orders at the bottom of the home screen to view past orders and ticket scans. You can even filter by winning tickets only. 👌

To make things even easier, we also offer a Wins & Losses Report to help out players who need this information for their taxes. Just email us at support@jackpocket.com to get your copy.

Keep in mind… As the IRS states, “These record-keeping suggestions are intended as general guidelines to help you establish your winnings and losses. They aren’t all-inclusive.” For more information, check out “How Do I Claim My Gambling Wins and/or Losses?” on the IRS website.

How are lottery winnings taxed by the state?

Once the federal government takes its share, you’ll know what to expect with your lottery winnings after taxes. But what is the tax rate on lottery winnings in your state? That depends on the state you live in. The amount of tax owed will be based on your state’s tax rate for lottery winnings. You can visit your state government website to find out more information.

Consider yourself lucky if you live in any of these states. They don’t charge state taxes on lottery winnings:

-

California

-

Delaware

-

Florida

-

New Hampshire

-

South Dakota

-

Tennessee

-

Texas

-

Washington

-

Wyoming

FAQs

Do I pay social security tax on my winnings?

No. Because this isn’t considered earned income, it is not subject to social security or medicare taxes.

What happens if I don’t report my winnings?

Both the state and federal governments compare your submitted tax return to the income reported to them from your employer and any other sources of income (such as from the lottery commission), and if they don’t match, you could be subject to penalties and interest on top of the additional tax due.

Do scratchers count?

Yep! Any gaming options count, and winnings must be reported with your tax return. It doesn’t matter if it’s scratchers, draw games, bingo, or games at a casino (such as slots or Blackjack). Everything counts.

I won $5 on a scratcher. Does it need to be reported?

All winnings, no matter how big or small, must be included on your income tax return, as all winnings are taxable.

I won $200 over the course of the year, but I lost $300. How much can I deduct on my taxes?

To deduct any losses from your eligible income, you must itemize your deductions and not take the standard deduction. You can only deduct as much of your losses as you claim in winnings. In this scenario, you could deduct $200 in losses, which equals the amount won, so long as you itemize your deductions on Form 1040, Schedule A.

We want to remind you that we at Jackpocket are not tax professionals. For the official word on lottery winnings and your federal and state taxes, double check the gambling income rules laid out at IRS.gov, your state taxing authority and contact a CPA or tax attorney.