Understanding the difference between the cash option and a Mega Millions annuity.

The winners of Mega Millions face some important questions. Should they choose the cash payout or the annuity payout? How much is a one-time payout for Mega Millions? How are lottery annuities paid out?

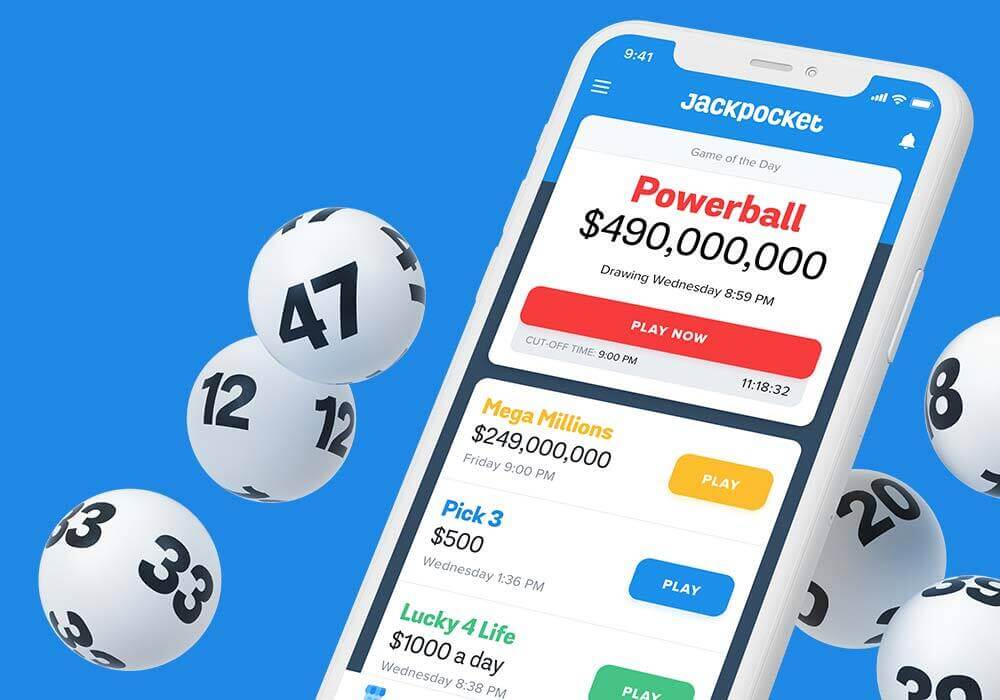

Sit back, relax, and let Jackpocket tell ya all about it.

Lottery Annuity vs Cash Payout – What’s the Difference?

Mega Millions winners can choose between taking cash immediately or the Mega Millions annuity. Understanding the differences between these choices is essential to making the most informed decision.

Cash Option: Winners who choose the cash option will receive a single lump sum payout, which is lower than the advertised jackpot amount.

Annuity Option: Winners who choose the Mega Millions annuity payout receive one initial lump sum payment followed by 29 annual payments equal to about 1.5% of the total prize.

What is the Mega Millions Annuity Payout?

For Mega Millions, the annuity option pays out the advertised jackpot over 30 years. Rather than equal installments, the payments increase by 5% each year to help offset inflation. Let’s break down what that really means.

Let’s say the advertised jackpot is $100 million. The total payout is distributed across 30 annual payments. The first payment would be approximately $1.5 million, and each subsequent payment would increase by 5%. By the 30th year, the final payment would be just over $6 million. Altogether, the sum of these increasing payments adds up to the full $100 million.

Benefits of Choosing the Mega Millions Annuity Payout

The annuity option is great if you want steady cash flow and long-term financial security. With 30 annual payments, you’re set for nearly three decades.

Plus, it helps with smart spending—winners can enjoy some of the jackpot now while investing for future growth, keeping both fun and financial stability in check.

Factors That Affect Mega Millions Annuity Payments

Several factors influence Mega Millions annuity payouts; here are some of the details:

-

Interest rates: When the grand prize is won, payments are determined by the prevailing interest rates. High interest rates allow lotteries to invest the cash more effectively, potentially leading to larger payouts over time.

-

Tax Implications: Annual payments are taxed in the year they are received. This spreads out the tax burden, but changing tax laws could impact your payouts.

-

Inflation: To counteract inflation, graduated payments are made, each of which increases by 5% over the previous year.

-

The winner passes away: Some states allow winners to name a beneficiary for their annuity payments. If no beneficiary is named, the winnings go to the winner’s estate.

Consulting with a financial advisor is a wise decision if you find yourself the winner of a grand prize in the lottery.

Get started now! Download the Jackpocket app today or order online.

Jackpocket does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors regarding your federal and state taxes.

FAQs

How is the Mega Millions annuity payout determined?

The annuity payout is based on the advertised jackpot and paid over 30 years, with payments increasing by 5% annually to keep up with inflation.

What happens if I pass away before receiving all annuity payments?

If you pick the annuity option, some states let you name a beneficiary. If you pass before all payments are made, your beneficiary gets the rest. If no beneficiary is named or your state doesn’t allow it, payments go to your estate.

Is the cash option better than the Mega Millions annuity payout?

Your choice comes down to personal preference and financial goals. The cash option gives you a lump sum upfront, while the annuity provides steady payments over 30 years with annual increases to combat inflation. Both have perks, so consider factors like long-term security, lifestyle, and taxes. A financial advisor can help you decide what’s best for you.